In a world obsessed with fast trades, hot stocks, and quarterly earnings calls, Nick Sleep built wealth the old-fashioned way: by doing almost nothing. From 2001 to 2014, Sleep’s Nomad Investment Partnership returned an astonishing 921%—beating Warren Buffett, George Soros, and the S&P 500. His secret? A mix of radical patience, minimalist portfolio design, and a philosophy that prized understanding human behavior over chasing financial fads.

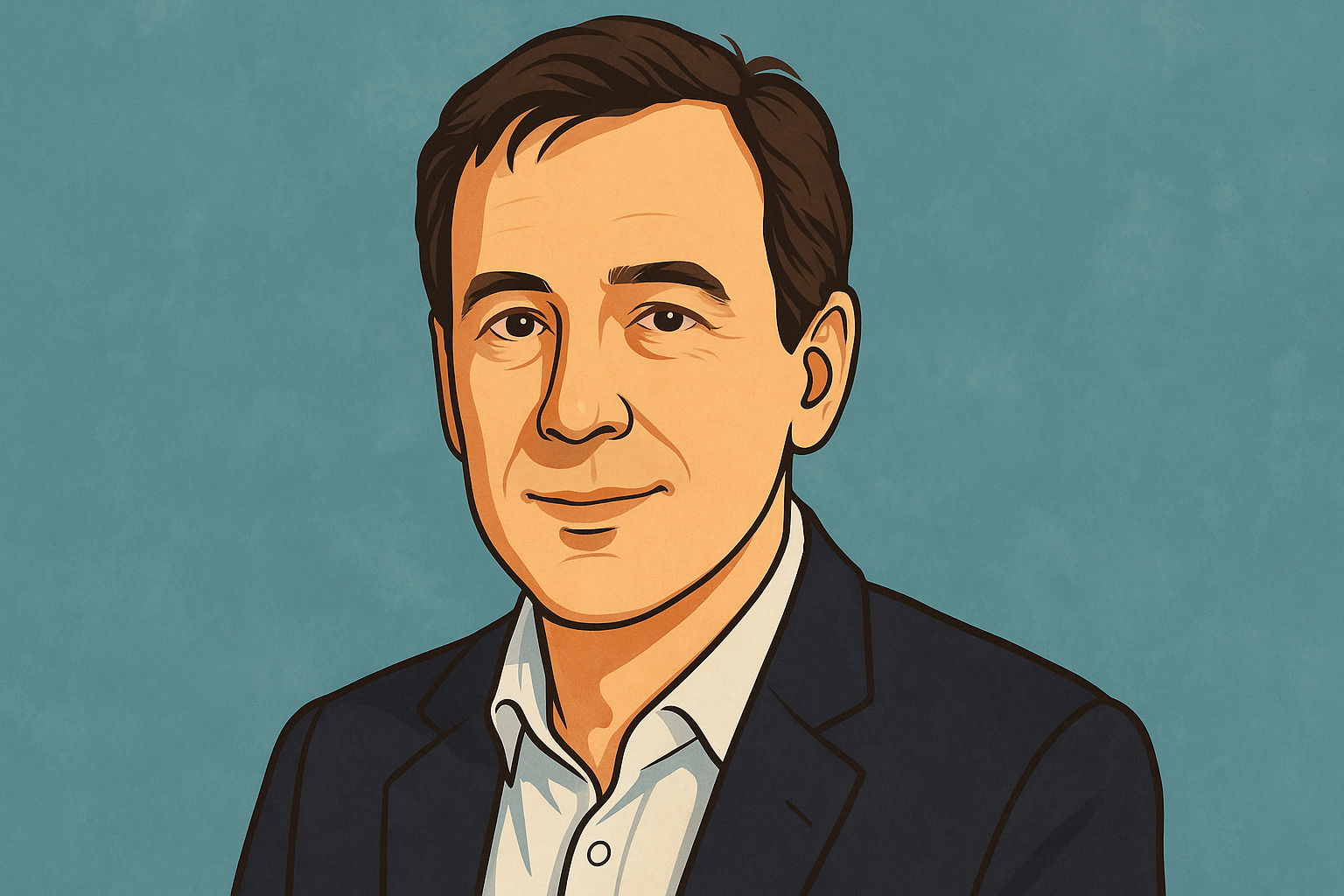

Sleep wasn’t your typical hedge fund mogul. He worked out of a modest London townhouse, charged minimal fees, wrote deeply philosophical investor letters—and then walked away from it all at age 45 to raise his children. Today, his letters circulate like underground gospel among venture capitalists, and his framework continues to guide some of the smartest money in the world.

The Nomad Letters: Investing’s Modern-Day Scripture

Sleep’s legacy isn’t just performance—it’s prose. His investor memos, written with partner Qais Zakaria, are revered for their clarity, humility, and timeless wisdom. These weren’t quarterly performance briefs—they were philosophical essays about business models, human psychology, and the power of patience.

Key Concepts from the Letters:

-

Scale Economies Shared: Sleep’s signature idea. Companies like Amazon and Costco reinvest cost savings into lower prices for customers, building loyalty loops that competitors can’t touch.

-

Time Arbitrage: While Wall Street traded on 90-day results, Sleep made bets based on 10+ year trends. He saw “time” itself as a market inefficiency he could exploit.

-

Radical Transparency: Sleep openly shared his failures—like a disastrous bet on Russian oil—making his letters as human as they were analytical.

🧠 “Compounding doesn’t need genius. It needs stillness.” — Nick Sleep

The Nomad Partnership: Two Rebels, One Philosophy

Founded in 2001, the Nomad Investment Partnership was anything but conventional. With no sales team, no flashy marketing, and just 15 hand-picked stocks, Nick Sleep and Qais Zakaria quietly built one of the most successful investment vehicles of the 21st century.

Key Practices:

-

Ultra-Focused Portfolio: Held only 15 stocks, compared to the 100+ positions common at big funds.

-

Low Turnover, Long Horizon: Average holding period? Seven years. Costco remained in the portfolio for a decade.

-

Fee Simplicity: A flat 1% fee—no performance bonus unless they beat the benchmark. Investor-aligned from day one.

The Results?

£100,000 invested in Nomad in 2001 grew to £1.02 million by 2014. The MSCI World Index? Just £217,000 over the same period.

Iconic Bets: Seeing What Others Missed

📦 Costco (2002)

Wall Street saw razor-thin margins. Sleep saw religion. Costco’s commitment to low prices—even $1.50 hot dogs—wasn’t inefficiency, it was strategy. The result? Wild customer loyalty and explosive volume growth. A $1 investment turned into $12 by 2014.

📦 Amazon (2005)

Critics slammed Jeff Bezos’ R&D spending. Sleep saw the future: cloud computing, logistics dominance, and an economic flywheel unlike anything before. “Amazon isn’t a retailer—it’s a scale machine eating capitalism,” he wrote.

⚡ Tesla (2013)

Though a late buyer, Sleep called Elon Musk a “modern Edison.” He believed Tesla’s cultural mission gave it a competitive moat beyond engineering.

The Five Pillars of Nick Sleep’s Investment Philosophy

1. Understand a Company’s DNA

Look deeper than earnings. Sleep believed enduring success lies in a company’s cultural code. Think IKEA’s $1 hot dogs—they reflect a philosophy that’s hard to replicate.

2. Bet on “Scale Economies Shared”

The companies that win? Those that pass their advantages to customers. It builds trust, loyalty, and scale that competitors can’t copy.

3. Ignore Market Noise

Turn off CNBC. Fed announcements, elections, hot takes—none of them matter when your investment horizon is a decade long.

4. Hold Onto Winners

Selling a great company just because it’s “up too much” is like divorcing your soulmate because they gained weight. Great businesses deserve to be held.

5. Focus on the Destination, Not the Discount

Early in his career, Sleep chased undervalued stocks. Later, he realized the real gold was in great businesses, even if they weren’t cheap on paper. Think: art, not just math.

The Exit: Wealth Without Ego

In 2014, Sleep and Zakaria shut down the fund—despite having hundreds of millions under management and more on the table. Sleep wanted to spend more time with his children. No fanfare, no media blitz. Just a graceful goodbye.

Today, Sleep’s name is whispered with reverence in elite circles. His ideas influence everything from Shopify’s partner-friendly strategy to Buffett’s Apple investment, to how venture capitalists view ecosystem-led businesses.

Conclusion: The Zen of Stillness

Nick Sleep didn’t build wealth by predicting the next big thing. He did it by deeply understanding businesses, trusting time, and staying still while the world spun chaotically around him.

His story is a call to slow down, think long-term, and invest in alignment with your values. In a market filled with noise, Nick Sleep found signal—and made history.

Pingback: Lee Byung-chul: Samsung's Visionary Founder