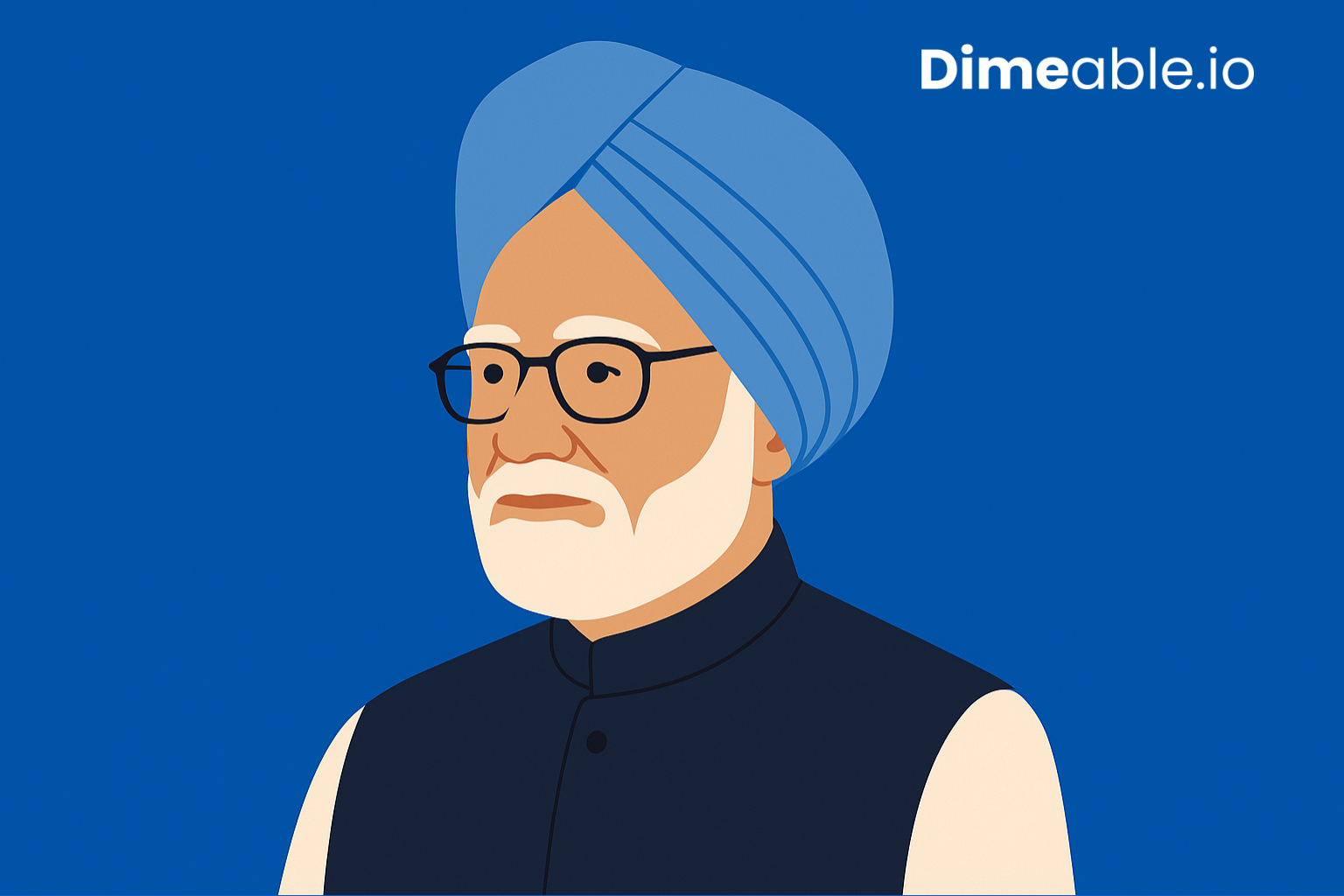

Picture this: July 1991. India has just 3 weeks of foreign cash left. Gold reserves are being airlifted to London as collateral. The country is hours away from defaulting on loans. Enter Dr. Manmohan Singh—a soft-spoken economist in a turban—who flips the script. Fast-forward to 2008: The world is collapsing under a financial meltdown, but India stays afloat. Guess who’s steering the ship? Same guy.

Let’s unpack how this unassuming hero pulled off not one, but two of India’s greatest economic escapes.

1991: The “License Raj” Disaster & Singh’s Big Bang Reforms

India’s Economy Was a Leaky Boat

In 1991, India was drowning in debt. The Soviet Union (a major trade partner) had collapsed, oil prices spiked due to the Gulf War, and foreign reserves were down to $1.2 billion—enough to cover just 15 days of imports. The country was like a student with maxed-out credit cards and no income.

Enter the “Architect of Modern India”

As Finance Minister, Manmohan Singh did the unthinkable: He ripped up India’s socialist rulebook. Here’s how:

-

Killed the License Raj: Scrapped rules requiring businesses to beg the government for permits to make anything (even lightbulbs!).

-

Opened the Floodgates: Welcomed foreign investment (hello, Pepsi and IBM!) and slashed import taxes.

-

Devalued the Rupee: Made Indian exports cheaper globally, boosting industries like textiles.

Fun Fact: Critics called him a “sellout.” But within 3 years, foreign reserves hit $20 billion. Mic drop.

2008: The Global Meltdown & Singh’s Steady Hand

When the World Was on Fire

By 2008, Singh was Prime Minister. The U.S. housing bubble had burst, Lehman Brothers imploded, and stock markets crashed globally. India’s growth rate dropped from 9% to 6.7%—still a miracle compared to the West’s nosedives.

How India Dodged the Bullet

Singh’s team didn’t panic. Instead, they:

-

Pumped in Cash: Rolled out a ₹30,700 crore ($7 billion) stimulus to boost demand.

-

Backed Banks: Ensured liquidity (cash flow) so banks wouldn’t fail like in the U.S.

-

Shielded Farmers: Waived ₹60,000 crore in farm loans to protect rural spending.

Key Quote: Singh famously said, “In a crisis, be bold.” His calm leadership kept India growing while the world reeled.

What Made Singh’s Strategies Work?

-

Long-Term Vision: He treated 1991 not as a quick fix but a launchpad for global competitiveness.

-

Trust in Experts: Relied on economists like Montek Singh Ahluwalia, not politicians.

-

No Drama: While others screamed “DOOM!”, he stuck to data and pragmatism.

Analogy Time: Think of Singh as a surgeon—cool under pressure, precise, and focused on healing, not headlines.

Lessons for Today’s Leaders

-

Crises Need Courage: Reforms hurt (1991 saw protests), but they prevent bigger collapses.

-

Global Shocks = Local Prep: Singh’s 1991 reforms built resilience that helped in 2008.

-

Silent Leaders Can Roar: You don’t need flashy speeches to save an economy—just grit and graphs.

FAQs: Your Questions, Answered

Q: What’s the “License Raj”?

A: A bureaucratic nightmare where businesses needed government approval for basic operations (imagine needing a permit to bake cookies!).

Q: Did Singh act alone in 1991?

A: Nope! PM Narasimha Rao backed him politically—proof that leaders + experts = magic.

Q: Why didn’t India crash in 2008?

A: Strong banks (thanks to Singh’s 1991 reforms) and quick stimulus saved the day.

Q: Was Singh popular for these moves?

A: Mixed bag. Short-term pain (like inflation) angered some, but history vindicated him.

Final Take: Why Singh’s Legacy Matters

Manmohan Singh proved that brains beat bluster. His 1991 and 2008 rescues weren’t about “saving the rupee” but saving futures—of businesses, farmers, and a generation dreaming of a modern India.

Next time you sip a Starbucks latte (thanks to 1991 reforms) or see India’s GDP beat expectations, tip your hat to the turbaned economist who dared to rewrite the rules.